Super Man On The Move

(Excerpts from the Book)

In 1979, the New York Stock Exchange contacted Western Union, requesting special teletypewriter equipment that they needed to support their requirements for trading floor expansion. Western Union referred NYSE to General Associates. General Associates sold the equipment to NYSE and established operations at the New York Stock Exchange, providing maintenance and service for trading floor operations. It gave General Associates an excellent opportunity to offer the NYSE technical expertise in the area of hardware and software development. The NYSE gave General Associates office space at the Stock Exchange at 11 Wall Street.In 1983, Ron developed a system to provide up to the minute bond quotation and trade information for the members of the New York Stock Exchange and other financial institutions. He successfully negotiated a contract with the New York Stock Exchange, to become a licensed financial vendor to disseminate quotes and trades of New York Stock Exchange listed bonds.

In 1979, the New York Stock Exchange contacted Western Union, requesting special teletypewriter equipment that they needed to support their requirements for trading floor expansion. Western Union referred NYSE to General Associates. General Associates sold the equipment to NYSE and established operations at the New York Stock Exchange, providing maintenance and service for trading floor operations. It gave General Associates an excellent opportunity to offer the NYSE technical expertise in the area of hardware and software development. The NYSE gave General Associates office space at the Stock Exchange at 11 Wall Street.In 1983, Ron developed a system to provide up to the minute bond quotation and trade information for the members of the New York Stock Exchange and other financial institutions. He successfully negotiated a contract with the New York Stock Exchange, to become a licensed financial vendor to disseminate quotes and trades of New York Stock Exchange listed bonds.

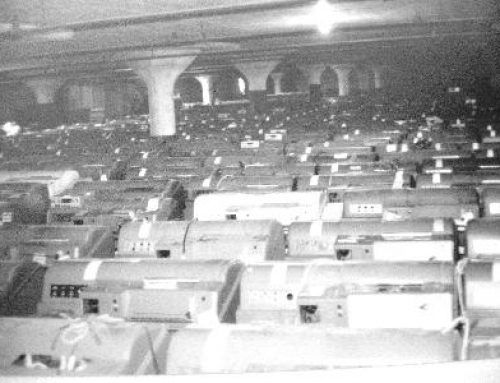

The project started when he saw that the New York Stock Exchange traded bonds on a bond-trading floor. When the bond traders in the Wall Street offices wanted to know the prices, they had to call in by telephone to their contact on the New York Stock Exchange bond-trading floor. Ron thought this was very antiquated. There was automated quotation service for stocks. Why not for bonds?

So, he developed a prototype system that would enable the pricing of bonds from the bond-trading floor, to appear at the bond broker’s desk at their Wall Street office. How would he market it? The traders were always extremely busy and it was impossible to talk to them during trading hours. He did not have the resources to advertise in the Wall Street Journal or other expensive media. So, he gave the system to a bond manager that he befriended, who was with a leading Wall Street firm. That manager did extremely well, by having the prices before anyone else, and he topped the other brokers’ bids. It wasn’t too long before the other firms were asking, “How are you able to top our bids so quickly?” He answered, “You need General Associates’ Bond Quote Monitor.” The phones started to ring off the hook with orders. Ron couldn’t get the monitors installed fast enough. Fifty percent of all the firms on Wall Street became customers. The project was very successful. It provided transparency and was operational for more than a quarter of a century.

I made something happen, by knowing how to recognize opportunity and using ingenuity.